The individual components of operating costs can be measured relative to total operating costs or total revenues to assist management in running a company. In addition, interest earned from cash such as checking or money market accounts is not included. Operating profit is the amount left after paying all related operating expenses and before deducting taxes and interests. Gross profit is the profit made from a company’s main activities, after deducting the cost of goods sold but before deducting any other operating expenses.

Resources

This situation arises when non-operational expenses, such as interest, taxes, or extraordinary charges, surpass the operating income. A high operating income is a positive sign for a company’s core activities, but it does not guarantee overall profitability. As an example of how to calculate operating income, imagine a company that has a gross profit of $1 million and operating expenses of $250,000. Operating profit, like gross profit and net profit, is a key financial metric used to determine the company’s worth for a potential buyout. The higher the operating profit as time goes by, the more effectively a company’s core business is being carried out. Operating earnings lie at the heart of both internal and external analysis of how a company is making money, as well as how much money it’s making.

Direct Costs

Last, the company is reporting a very material increase in provision for income taxes as Apple, Inc. estimated an additional $1 billion of expenses from what had been incurred one year ago. Because this expense is not directly tied to operational functions of the company, this increase has no bearing on operational income (though it does factor into net income). Operating income is a measurement that shows how much of a company’s revenue will eventually become profits accounting, cpa and tax prep houston considering its business operations. It’s a measurement of what money a company makes only looking at the strictly operational aspect of its company. EBIT is a profitability metric that helps assess how a company is performing, which is calculated by measuring profit before payment of interest to lenders or creditors and taxes to the government. It is a profitability calculation measured in terms of dollars and not in percentages like most other financial terms.

- Gross profit is helpful in understanding the direct costs required to produce the goods that have been sold.

- These include wages, rent, utilities, raw materials, and other expenses essential for running the business.

- Operating income is recorded on the income statement, and can be found toward the bottom of the statement as its own line item.

- In the given case, only $500,000 is operating revenue as it is only related to the core activity of the business, and profit on the sale of equipment is not a part of operating revenue.

- Now let us take the Apple Inc.’s published financial statement example for the last three accounting periods.

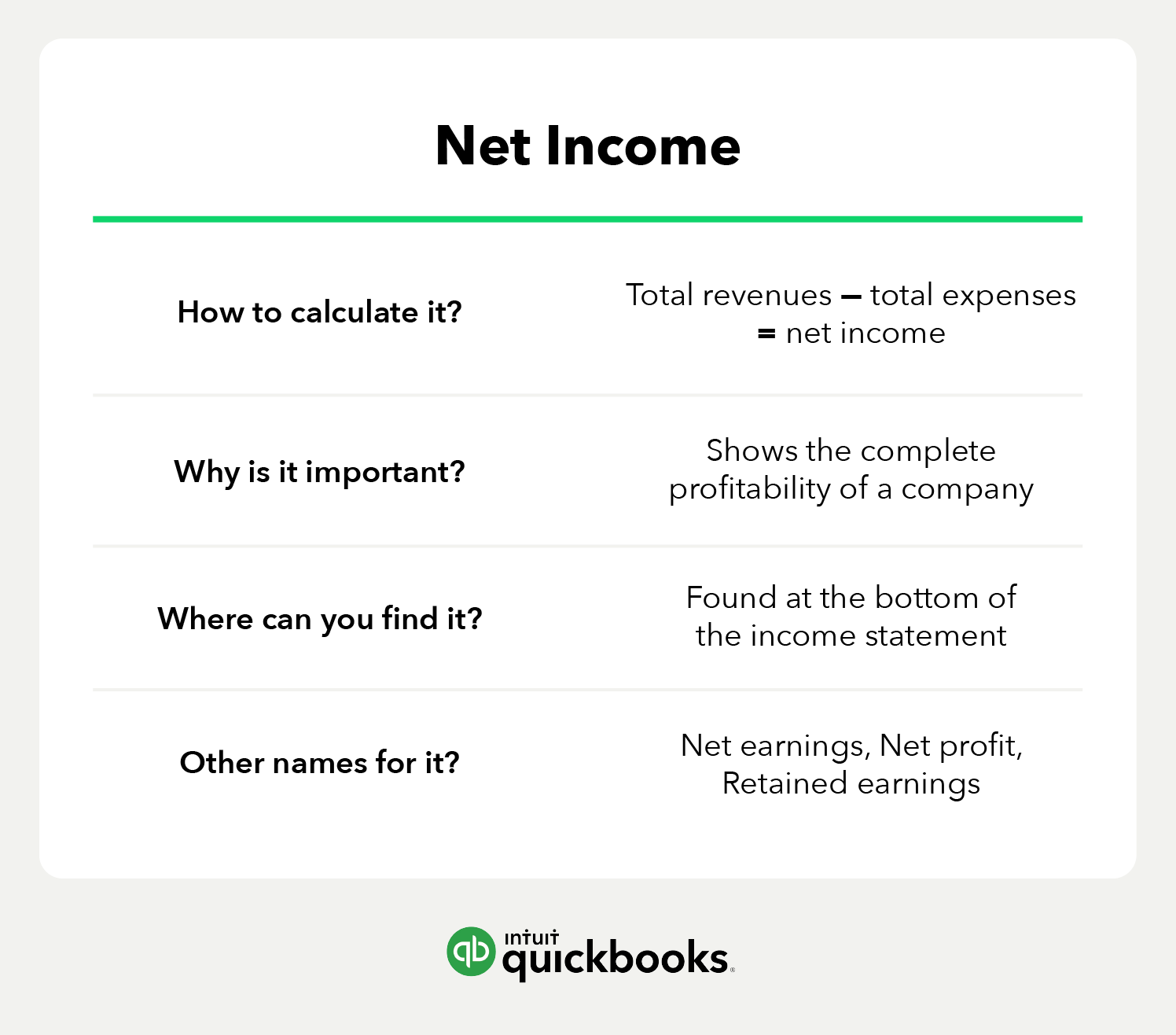

How to Improve Operating Profit

Remember that operating profit is an accounting metric for the stakeholders who care about the operational profitability of the company. Earnings before interest, taxes, depreciation, and amortization (EBITDA), on the other hand, is a cash-focused metric for stakeholders who care about the cash flow of the business. Operating profit is calculated by subtracting a company’s operating expenses from its gross profit. It is calculated by taking a company’s revenue and subtracting the cost of goods sold (COGS) and operating expenses. Examples of expenses used in net income but not operating income include interest, taxes, income from asset sales or other alternate revenue streams, one-time losses and various other uncommon expenses.

Calculation Examples of Operating Income

A business’s operating expenses are costs incurred from normal operating activities and include items such as office supplies and utilities. It’s different from gross profit, which can be defined as the money earned by a company after deducting the cost of goods sold. A company calculates its operating profits by subtracting its net sales’ operational direct and indirect costs from its revenue. You must understand the operations of a company before you can determine the operating income.

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity). Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Operating expenses encompass all costs directly related to a company’s daily business operations. These include wages, rent, utilities, raw materials, and other expenses essential for running the business. Operating income is similar to a company’s earnings before interest and taxes (EBIT); it is also referred to as the operating profit or recurring profit. Both measurements calculate the amount of money a company earned less a few noncontrollable costs. Technically, EBIT may include other operating expenses outside of interest and taxes but for most companies, these two calculations will be the same. The operating income formula has limitations as it focuses solely on operating expenses and doesn’t consider non-operating expenses, taxes, or interest costs.

However, it does not take into consideration taxes, interest or financing charges. Operating income is considered a critical indicator of how efficiently a business is operating. It is an indirect measure of productivity and a company’s ability to generate more earnings, which can then be used to further expand the business. Investors closely monitor operating profit in order to assess the trend of a company’s efficiency over a period of time. Sometimes a company presents a non-GAAP “adjusted” operating earnings figure to account for one-off costs that management believes are not part of recurring operating expenses. Operating earnings are usually found within a company’s financial statements —specifically, towards the end of the income statement.

Though it gets close to the nitty-gritty, operating earnings aren’t quite the famed “bottom line” that truly signals how well—or how poorly–a firm is faring. That status belongs to a company’s net income, “net” indicating what remains after deducting taxes, debt repayments, interest charges, and all the other non-operating debits a business has encountered. Because the metric excludes non-operating expenses, such as interest payments and taxes, it enables an assessment of how well the company’s chief lines of business are doing. Operating profit is calculated by taking revenue and then subtracting the cost of goods sold, operating expenses, depreciation, and amortization.