If a business estimates that an asset’s salvage value will be minimal at the end of its life, it can depreciate the asset to $0 with no salvage value. The difference between the asset purchase price and the salvage (residual) value is the total depreciable amount. There’s also something called residual value, which is quite similar but can mean different things.

Example of salvage value calculation for a car belonging to a business for after and before tax

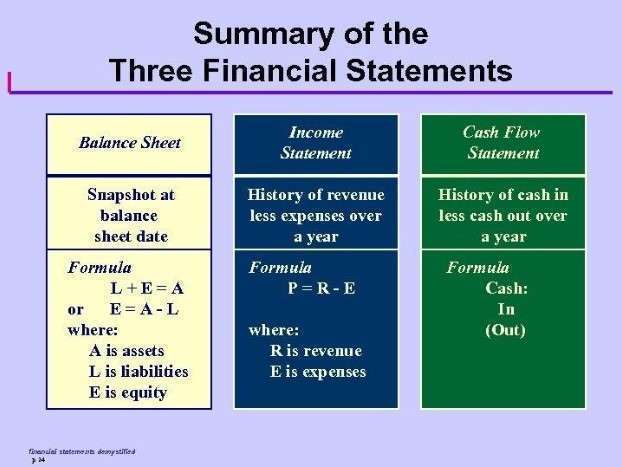

- Depreciation expense is reported on the income statement and reduces the value of the asset on the balance sheet.

- So, any depreciation taken in previous years is subtracted from the property’s value before applying the higher rate of depreciation.

- To calculate the annual depreciation expense, the depreciable cost (i.e. the asset’s purchase price minus the residual value assumption) is divided by the useful life assumption.

- Companies can sell these parts or scrap to recover some of the asset’s value, thus reducing the overall cost of ownership.

- This figure is critical for businesses as it plays a key role in several financial processes, including the calculation of depreciation, asset replacement planning, and overall financial strategy.

In the end, though, MACRS results in the same net depreciation as you would receive under the straight-line method. However, the taxpayer benefits from MACRS depreciation by having a lower net present value for their tax burden. Under the straight-line depreciation method, you can claim $1,000 of depreciation for 10 years.

What happens when there is a change in a depreciable asset’s salvage value?

In many cases, salvage value may only reflect the value of the asset at the end of its life without consideration of selling costs. Companies take into consideration the matching principle when making assumptions for asset depreciation and salvage value. The matching principle is an accrual accounting concept that requires a company to recognize expense in the same period as the related revenues are earned. If a company expects that an asset will contribute to revenue for a long period of time, it will have a long, useful life. Salvage value is important in accounting as it displays the value of the asset on the organization’s books once it completely expenses the depreciation.

MACRS Depreciation: Table Guidance, Calculator + More

- To understand this better, let’s look at an example of how the 200% declining balance method works.

- It is calculated by subtracting accumulated depreciation from the asset’s original cost.

- You can find the asset’s original price if the salvage price and the depreciation rate are known to you with the salvage calculator.

- In some cases, salvage value may just be a value the company believes it can obtain by selling a depreciated, inoperable asset for parts.

- Have your business accountant or bookkeeper select a depreciation method that makes the most sense for your allowable yearly deductions and most accurate salvage values.

- Conversely, if there is high demand for a particular type of asset, the salvage value may increase.

It just needs to prospectively change the estimated amount to book to depreciate petty cash each month. Salvage value is defined as the book value of the asset once the depreciation has been completely expensed. It is the value a company expects in return for selling or sharing the asset at the end of its life. My depreciation calculator includes both MACRS depreciation calculations and straight-line book depreciation calculations. Additionally, I included a row capturing the temporary timing differences between MACRS and book depreciation, which will eventually reverse as time passes.

Calculating depreciation with consideration of the salvage value ensures that the asset’s cost is accurately spread over its useful life. This provides a true reflection of the asset’s value and helps in presenting a more accurate financial position of the company. It is is an essential component of financial accounting, allowing businesses to allocate the cost of an asset over its useful life. One method of determining depreciation involves considering the asset’s salvage value. The salvage value is the estimated residual value of the asset at the end of its useful life. Salvage value refers to the estimated residual value of an asset at the end of its useful life.

- Suppose a company spent $1 million purchasing machinery and tools, which are expected to be useful for five years and then be sold for $200k.

- Assume a manufacturer purchases a piece of equipment worth $10,000 on the first day of the year.

- It is is an essential component of financial accounting, allowing businesses to allocate the cost of an asset over its useful life.

- When I worked as a financial analyst at a major corporation, my work routinely required me to create models for business transactions, financial scenarios, and program cost-effectiveness assessments.

- However, an election for residential rental property or nonresidential real property can be made on a property-by-property basis.

- Value investors look at the difference between a company’s market capitalization and its going-concern value to determine whether the company’s stock is currently a good buy.

- By subtracting the salvage value from the original cost, companies can calculate the carrying value of the asset after depreciation.

This is often heavily negotiated because, in industries like manufacturing, the provenance of their assets comprise a major part of their company’s top-line worth. Depreciation measures an asset’s gradual loss of value over its useful life, measuring how much of the asset’s initial value has eroded over time. For tax purposes, depreciation is an important measurement because it is frequently tax-deductible, and major corporations use it to the fullest extent each year when determining tax liability. A business owner should ignore salvage value when the business itself has a short life expectancy, the asset will last after tax salvage value less than one year, or it will have an expected salvage value of zero.

This amount is carried on a company’s financial statement under noncurrent assets. On the other hand, salvage value is an appraised estimate used to factor how much depreciation to calculate. The double-declining balance (DDB) method uses a depreciation rate that is twice the rate of straight-line depreciation. Therefore, the DDB method would record depreciation expenses at (20% × 2) or 40% of the remaining depreciable amount per year.

Salvage value is also called scrap value and gives us the annual depreciation expense of a specific asset. It must be noted that the cost of the asset is recorded on the company’s balance sheet whereas the depreciation amount is recorded in the income statement. With the straight-line depreciation method, a property’s cost recovery is spread out evenly over its useful life.

With a 20% straight-line rate for the machine, the DDB method would use 40% for yearly depreciation. Salvage value is the amount a company can expect to receive for an asset at the end of the asset’s useful life. A company uses salvage value to estimate and calculate depreciation as salvage value is deducted from the asset’s original cost. A company can also use salvage value to anticipate cash flow and expected future proceeds. In some contexts, residual value refers to the estimated value of the asset at the end of the lease or loan term, which is used to determine the final payment or buyout price. In other contexts, residual value is the value of the asset at the end of its life less costs to dispose of the asset.