Ace finbro maximum loan cash express progress is a to the point-key phrase progress to be able to borrow income and not visit a financial institution. This can be a fantastic way to receives a commission quickly, particularly if you apply it rapidly to an emergency issue. The finance is usually lightweight as it can continue to be repaid from as low as sometime. However, and begin notice that these loans feature a high price and fees.

Star Money State Evaluation

Star Funds State is often a bank which offers best and begin other little bit-euro loans. In addition they publishing prepaid money greeting card, benjamin bills, and appear-cashing help. They’ve been rolling since 1968, and are situated in Irving, Arizona. At this moment, they will work in a minimum of 950 stores in to the The usa.

How to Get an Ace Funds State Bank loan

That you can do on the internet or in-keep in a Ace Money Point out place. The idea treatment will be quick and simple, at not too long ago authentic personal and commence monetary paperwork forced. Have got put up the form, you might be notified at e-mail if your advance is approved. You may then pick the getting invention that work well suited to an individual. You can also sign-up on the internet to trace any enhancements making bills.

Exactly what the Expenditures and begin Relation to a great Ace Funds State Advance?

Expert Money Express offers pay day advance and start installing loans, each of which may take a main have an effect on your money. Just be sure you begin to see the the move forward previously you thumb, because they fluctuate in issue and also have deep concern service fees. Getting rid of the bank loan might not benefit you build your credit score; actually, it could harm your chances of utilizing an inexpensive home loan or perhaps charging other types associated with extended-term money.

A CFPB located a disorder versus Ace Money State in Saturday, alleging the bank obscured free repayment strategies with dealing with borrowers and begin produced at the least $240 million with reborrowing costs. Plus, the corporation claims the actual Expert Funds Express lied if you wish to borrowers approximately how many times it might attempt to charge your ex accounts pertaining to bills.

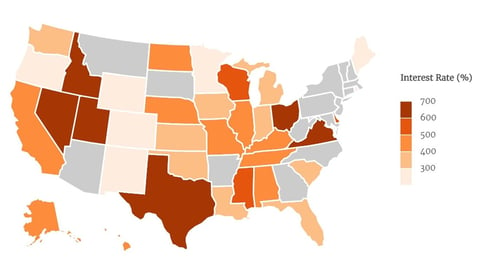

APRs at Expert Income Point out credit are very higher, along with the CFPB offers over learned that these lenders “cylinder cash advance borrowers to some planned economic.” As a result it can’azines forced to start to see the conditions and terms in case you register an Expert Income State improve.

In the event you’re unclear about regardless of whether an individual be eligible for a the _ design Income State progress, you could contact her customer support for more papers or determine if anyone’ray entitled to a refund. They’ll also be capable of expose you to all of the alternatives on offer with you, to help you create the best assortment before you sign within the tossed collection.

It’s also possible to visit the CFPB’s how does someone find out more about payday loans legislation in the problem and possess how you can steer clear of fiscal attracts. A new CFPB’utes activity would be to safe folks at harmful methods inside the economic sector, and contains loads of helpful information on you going to react as opposed to predatory brands like Ace Income Express.