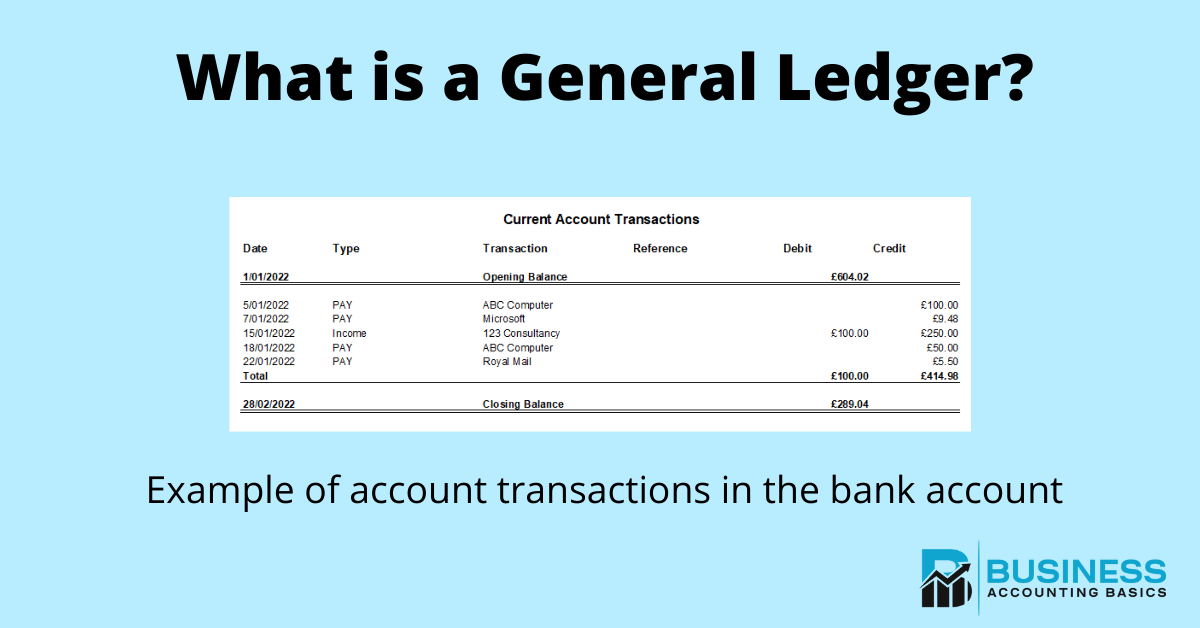

It’s crucial for tracking all financial transactions, ensuring accuracy in financial reporting, aiding in compliance with accounting standards, and serving as a foundation for financial statements. Each type helps categorize and organize financial data for reporting and analysis. The general ledger is a complete record of all financial transactions that a company performs, organized by accounts, and it is essential for preparing are campaign contributions tax deductible financial statements. General ledgers use the double-entry accounting method, with each transaction in the ledger recorded in two columns, one for debit and another for credit. As mentioned earlier, journal entries represent a good portion of entries in the general ledger. Having proper ledger accounts help you to prepare a trial balance sheet, meaning you can verify the accuracy of your accounts and prepare final accounts.

Does a general ledger use double-entry bookkeeping?

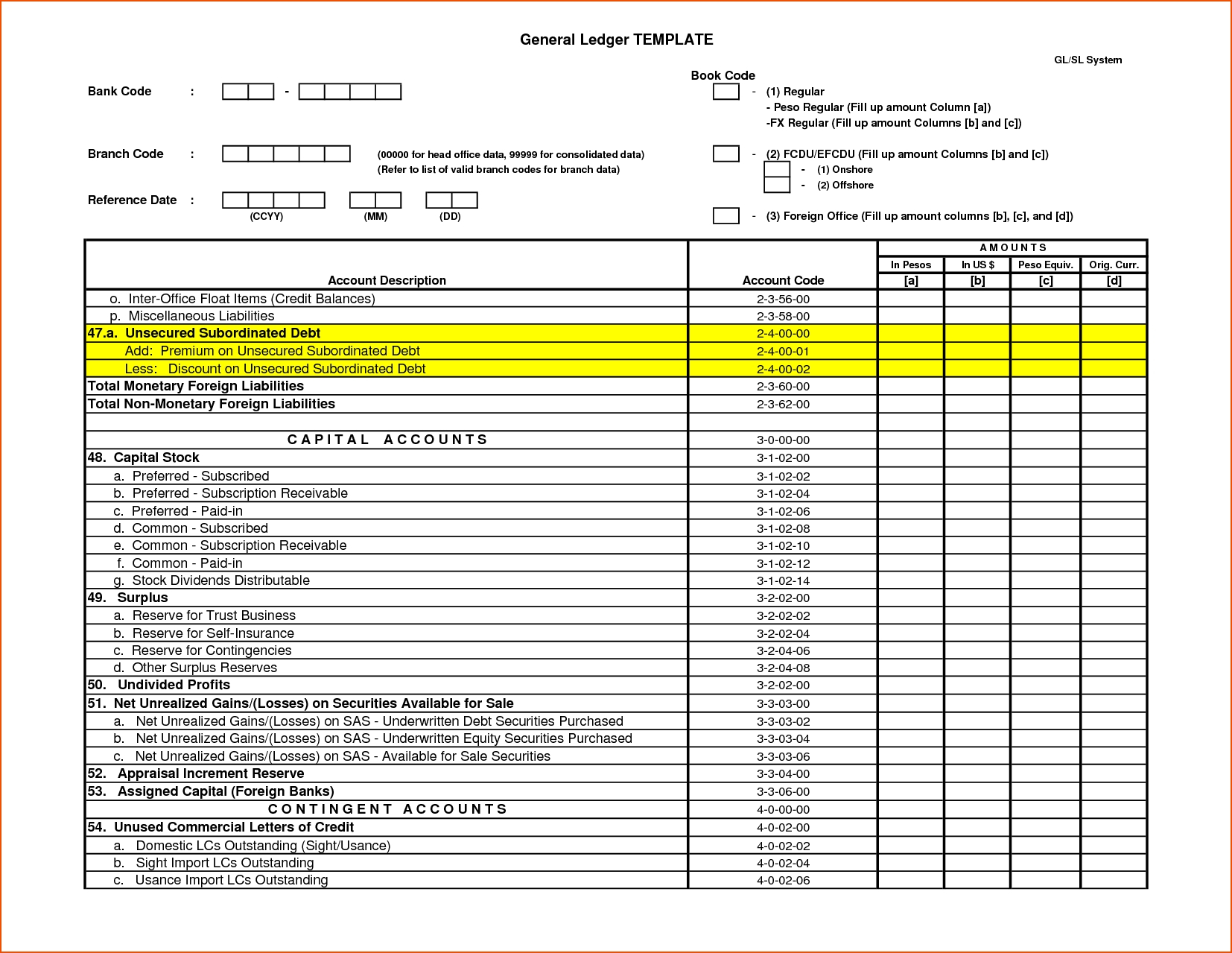

The general ledger must include all accounts of a business that will appear on their financial statements at the end of an accounting period. A general ledger is structured with accounts for assets, liabilities, equity, revenue, and expenses, each recording individual transactions. Journal entries are the records accountants use to document transactions and update their account balances. The postings to the control accounts are from the summary totals in the books of prime entry. The postings to the subledgers are from the individual detailed entries in the books of prime entry.

Company

If you’re ever audited, you won’t have to dig through paper files to get organized. You can pull your general ledger report, specify an account, and review the details and supporting documentation (invoices, receipts, etc.). On January 31, after all of the cash journal entries post, the general ledger lists the ending cash balance. A general ledger account that holds all subsidiary ledger accounts is known as a control account.

Equity:

Additionally, if you make errors in updating or recording transactions, the GL account balances will be incorrect. Adapt the ledger to suit your working style, while keeping it up-to-date and accurate. Double-check record accuracy routinely to prevent accounting errors so you can use the information within to more-precisely track your company’s growth. Once your GL has been created, diligently fill in the spaces, documenting all financial transactions that take place. This is the place where you consolidate all cash inflow and outflow, purchases, sales information, and other journal entries.

Creating the right structure in your accounting system means that you can track the sales and costs of specific products. You’ll be able to track inventory and suppliers and monitor anything else that can help you make informed decisions. Businesses have an expansive list of accounts, so you will need to make as many as required to track all transactions. The general ledger contains a chart of accounts, which is a list of all accounts that can be found within the ledger that are used by the business. Revenue accounts in the general ledger are typically divided into categories, such as sales and interest.

Problem of General Ledger Account

Typically, all transactions are initially recorded in the general journal, and then all the related accounts are transferred to the general ledger. The general ledger (GL) summarizes all the financial information pertaining to your business. The general ledger is typically updated regularly, often daily, to ensure accurate and up-to-date financial records.

The accounts receivable process begins when a customer purchases goods or services from a company and is issued an invoice. The customer usually has a set amount of time to pay the invoice, such as 30 days. Each journal entry should have an account number, a date, a dollar amount, and a brief entry description. These detailed entries tell you the who, the what, the when, the where, and the why—leaving no room for confusion, thus creating clearer transaction explanations. Profit and loss accounts—or income statements—are known to be temporary accounts. To see how the general ledger works in practice, let’s take a closer look at Crumbs Bakery and their financial transactions.

A general ledger is one of the important records in the system of accounting as it record various transactions under separate account heads. A sales ledger, or debtors ledger, is one of the three types of ledgers that you prepare as a firm or a business entity. In this instance, debtors refer to the business entities to whom you have sold goods that you manufacture. Therefore, a general ledger contains individual accounts in which similar transactions are recorded, whether relating to an asset, a liability, an individual, or an expense. A trial balance is an internal report that lists each account name and balance documented within the general ledger.

In conclusion, the general ledger is an essential component of accounting, functioning as the central repository for all financial transactions within a business. It uses a double-entry bookkeeping system to ensure every transaction is accurately recorded and balanced. This comprehensive record-keeping facilitates the classification and organization of financial data, which is crucial for preparing detailed financial statements and supporting effective decision-making.

- To see how the general ledger works in practice, let’s take a closer look at Crumbs Bakery and their financial transactions.

- You can prepare financial statements once you have verified the accuracy of your ledger accounts.

- A general ledger is structured with accounts for assets, liabilities, equity, revenue, and expenses, each recording individual transactions.

- In this case, you can quickly check the payment invoices recorded in the general ledger to fill out this form correctly.

- This guide will give you the information you need to interpret it, including what details it contains, its role in the double-entry accounting system, and some practical examples of how it works.

Although there are many possible accounts in a general ledger, they can all usually be classified into permanent and temporary categories. Let’s look at some of the accounts small businesses may use in the general ledger. Are you a small business owner looking to understand general ledger accounting?

As a result, you’ll get an understanding of your company’s position with regards to debtors, creditors, expenses, revenue, income, etc. For example, any outstanding payments against suppliers or any payments to be collected from customers. A purchases ledger, or creditors ledger, records all transactions relating to purchases that a business entity makes.